31+ debt income ratio for mortgage

Some lenders may accept a debt-to-income ratio of. Lock Your Mortgage Rate Today.

Ex 99 1

Learn how we support ag rural communities with reliable credit financial services.

. Trusted VA Loan Lender of 300000 Veterans Nationwide. Web Your monthly debt payments would be as follows. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan.

Total monthly debt paymentsGross. Ad Check Your Eligibility See If You Qualify for a 0 Down VA Mortgage Loan. Ad At Compeer Financial were here to help our clients live and do business in rural America.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Web Heres how the debt-to-income ratio is calculated. Debt-to-Income Ratio and Mortgages.

Receive 1000 Off On Pre-Approved Loans. Ad Well Help You Calculate Your VA Loan Entitlement And Get Pre-Qualified For Your New Home. Ad Use Our Comparison Site Find Out How to Get Home Loan Pre Approval In Minutes.

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Web As a general rule your debt-to-income ratio should remain below 36 with no more than 28 of your income going toward mortgage-related expenses. Were Americas Largest Mortgage Lender.

Highest Satisfaction for Home Loan Origination. That means if you earn 5000 in monthly gross income your total debt obligations should be. Only Takes Minutes to Get Preapproved with a VA Lender.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Choose a Loan That Suits Your Needs. Web About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features NFL Sunday Ticket Press Copyright.

Ad Skip the Bank Save With National Top Lender Pennymac For Your New Home Loan. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Total monthly debt paymentsGross monthly income x 100 Debt-to-income ratio.

The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall. Web In general lenders prefer that your back-end ratio not exceed 36. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033.

If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000 6000 033. In this formula total monthly debt. FHA limits are currently 3143.

Web Debt-To-Income Ratio - DTI. Lenders prefer you spend 28 or less of your gross monthly income on housing expenses. Web In the consumer mortgage industry debt-to-income ratio.

Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt. Finance Your Dream Home with the Lowest Rates. Ad Get the Best Mortgage Offers Compare Top Companies and Get Great Deals.

FHA guidelines call for front-end. Web Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Start Your VA Loan Application Online Today And Find Out How Much You Can Afford.

Apply Online To Enjoy A Service. 2014 implemented a debt to income multiplier on mortgages of 45 A consumer. Web Find out how debt-to-income ratio works and what yours should be at if applying for a mortgage.

Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house. Trusted VA Loan Lender of 300000 Veterans Nationwide. Apply Now With Quicken Loans.

Ad Compare Mortgage Options Calculate Payments.

Axos Financial Inc Axos Financial Inc Fixed Income Investor Presentation February 2022 Nyse Ax Filed Pursuant To Rule 433 Registration No 333 253797 Issuer Free Writing Prospectus Dated February 16 2022 Relating

Debt To Income Ratio Calculator Nerdwallet

Debt To Income Ratio Crb Kenya

What Debt To Income Ratio Is Needed For A Mortgage Tally

Image7 Jpg

What Debt To Income Ratio Is Needed For A Mortgage Tally

What Is The Debt To Income Ratio For A Mortgage Freeandclear

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

The Financial Budget Manual By Aginfo Issuu

Debt To Income Dti Ratio Calculator Money

Need A Mortgage Keep Debt Levels In Check The New York Times

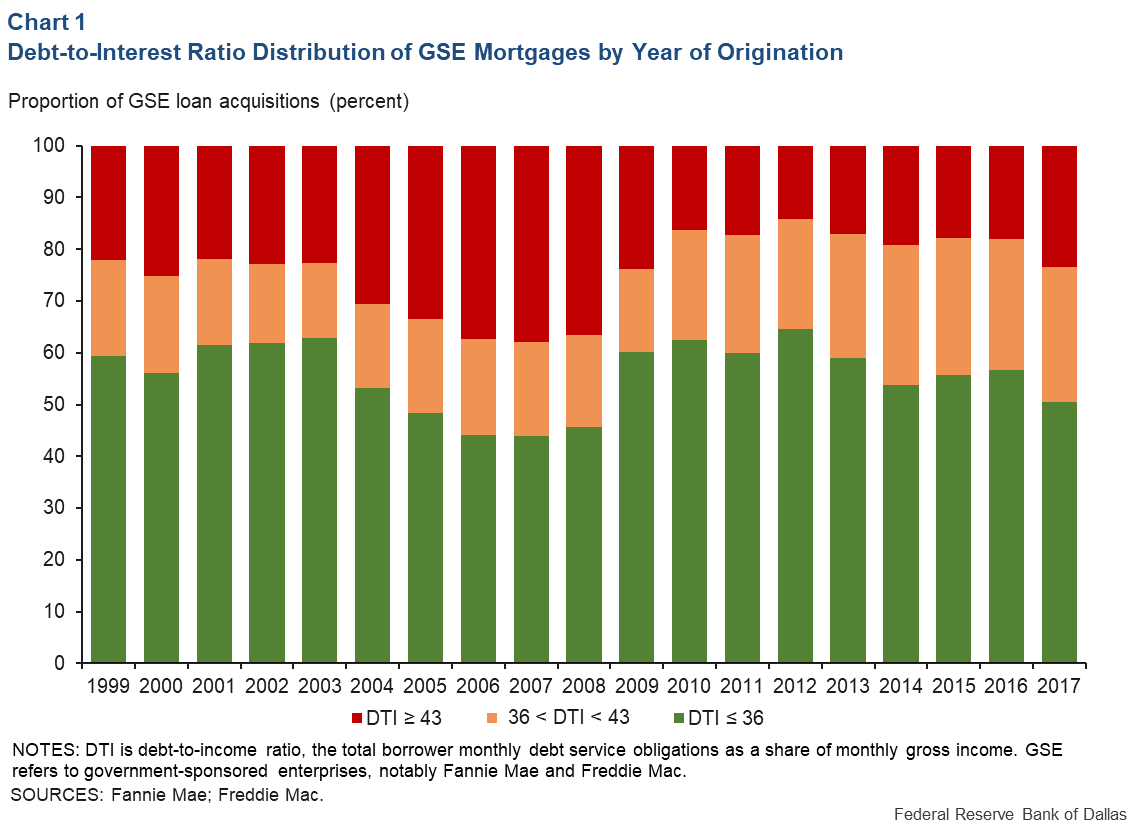

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org

What S A Good Debt To Income Ratio For A Mortgage

Calculate Debt To Income Ratio Dti For Mortgage Guaranteed Rate